How "Digital India" and "Make in India" Strengthen India's Tech Giant-#StartupIndia

- Digital India and Make In India were conceived as a call to action for Indian innovators and business leaders.

- Both initiatives are important cogs in PM's vision to make India a global technology superpower.

- Below, we take a closer look at the progress, milestones, and challenges of these initiatives.

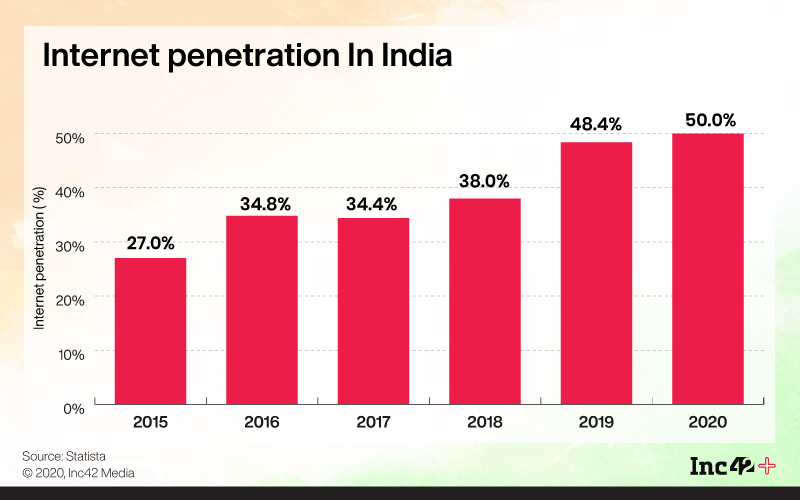

In 2014, India had just over 233 million internet users out of a population just under 1.3 billion, with a low penetration rate below 20%. But with its focus on technology and the momentum of India's digital economy, the new government that was formed in 2014 set out to change this.

In September 2014, Prime Minister Narendra Modi launched one of the flagship projects "Make In India" among a number of other initiatives to build the digital economy. In July 2015, the launch of Digital India signaled India's intention to become a global technology superpower.

While Make In India was designed to transform India into a global design and manufacturing hub from an import-focused consumer market, the Digital India program aimed to revive infrastructure projects and bring a measure of digitization across aspects of life, from finance to education and commerce and governance. Together, Digital India and Make In India served as a powerful call to action for India's innovators, citizens and business leaders. More importantly, it was an invitation to potential partners and investors from around the world that India was ready to become more than just a mass consumer market.

Changing the game for tech startups

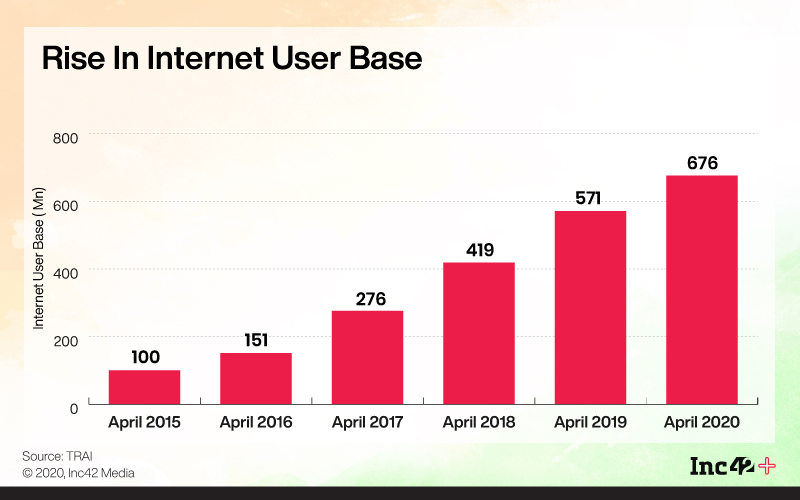

One of the main indicators of digital transformation in India is the increase in the number of Internet subscribers in India. From around 233 million in 2014, India today has more than 504 million active Internet users. Much of the credit for this goes to the launch of Reliance Jio, which completely changed the telecommunications and mobile internet game in 2016. In July 2020, TRAI reported 676 million broadband subscribers in India, including wireless connections. and wired. Additionally, India has more than 1.14 billion mobile subscribers, of which 629 million are in urban areas.

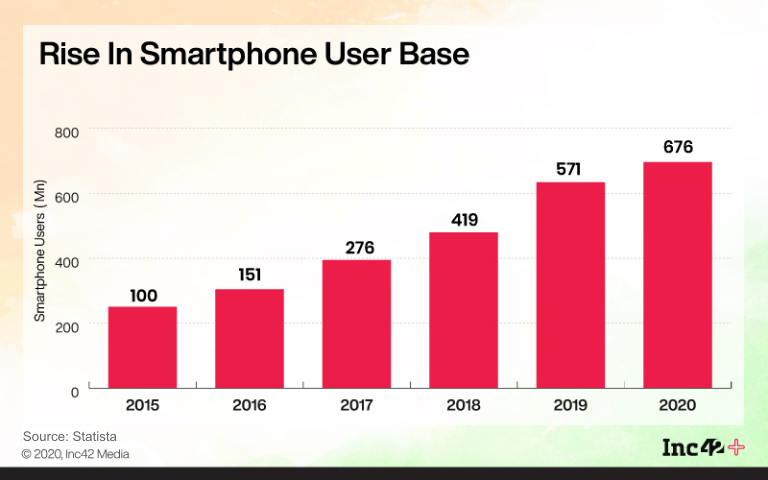

According to Mary Meeker's 2019 Internet Trends Report, the global Internet user base has reached 3.8 billion, more than half of the world's population. Of these, India has around 12% of the stake. As a result of the increased penetration of smartphones and mobile internet, Indian startups have also focused their efforts on attracting the so-called next billion consumers to the digital fold.

A key part of the non-mobile momentum comes from BharatNet, which initially aimed to connect 2.5 lakh-gram panchayats with high-speed internet. So far (August 2020), 1.42 Lakh Gram Panchayats are connected with fiber optics.

One of the main goals of Digital India was to bridge the huge digital divide between urban and rural India. While we are still many years away from reaching parity, some of the initiatives taken by the government towards this goal include the Aadhaar registry, Jan Dhan Yojana, and common service centers (CSCs), among others. Of course, the role of private sector companies like Reliance Jio, Google, Facebook, and smartphone brands like Xiaomi cannot be ignored in this context.

Between 2014 and July 2019, more than 3 Lakh CSCs were established across the country, according to Ravi Shankar Prasad. These CSCs are said to have built digital literacy among 1.5 Cr. Indians and provided employment for 12 Lakh youth. However, an official post in June 2019 noted that more than 11K gram panchayats do not have access to CSC, so while the journey from 2014 onwards has been fruitful in many ways, there is still a long way to go, something that It stood out during the early days of the confinement when many struggled to go online for their school lessons and remote work.

Why local manufacturing is closely linked to the dream of digital India

Another key pillar in the growth of India's digital economy has been the fact that Indians have shown a huge appetite for smartphones and mobile devices. Exactly one year ago, India emerged as the fastest growing smartphone market in the world, while in January 2020, India surpassed the US to become the second largest smartphone market in the world.

But to get there there has been a combination of smartphone manufacturers that focused heavily on the Indian market, not only in terms of new devices but also electronics manufacturing. Passed in February 2020, the National Electronics Policy 2019 (NPE 2019) is expected to carry forward the momentum that India has shown in electronics manufacturing. With China being marginalized for a number of reasons, including the pandemic, India has become the next big destination for electronics manufacturers and the government has placed emphasis on India becoming an export hub in this regard. The 2019 NPE aims to achieve a turnover of $ 400 billion by 2025 in Electronic Systems Design and Manufacture (ESDM).

According to the World Bank, in 2018 the manufacturing sector contributed only 15% of India's total annual GDP, compared to 29% in China and 18% in Bangladesh. The policy aims to change this with a specific production of 1 billion mobile phones by 2025, valued at $ 190 billion, including 600 million mobile phones valued at $ 110 billion for export.

According to Datalabs by Inc42, industrial and manufacturing SaaS solutions, as well as deep technology products and services, will play a critical role in advancing the "Make In India" mission, as automation and digitization are key to increasing overall productivity in manufacturing. Increasing the contribution of the manufacturing sector to India's overall GDP should be an important action point for the government and businesses, as this will also directly contribute to digital growth. With more and more electronic products and parts made in India, India will have the first access to these technologies, as has been the case in China for more than two decades.

In addition to SMEs in manufacturing, clean energy is another key focus area for Make in India. The Department for the Promotion of Industry and Domestic Trade (DPIIT) has recently proposed the conclusion of FTAs (free trade agreements) and mining agreements with Latin America and Africa, which are countries rich in resources, particularly lithium and cobalt, which They are used to make batteries. that constitute about 40% of the cost of electric vehicles. With these strategic trade agreements, the cost of vehicles is expected to fall in the near future, thus driving the adoption of electric vehicles in the country.

With this, India aims to explore trade agreements with countries that support the vision of "Aatmanirbhar Bharat", thus providing the necessary raw materials, critical components and equipment necessary to support local manufacturing.

The various pieces of digital India

Of course, the digital economy is not based only on devices that can connect to the Internet at little or no cost. The economy is underpinned by digital products and services, which is where startups have emerged as the biggest advocate for Digital India. Key sectors such as education, banking and finance, B2B commerce and commerce, governance and essential service delivery, agriculture and others have been transformed through a mix of early policy-backed innovation.

Over the years, the MHRD Ministry of India has launched online learning and communication technology initiatives. This includes a huge open platform of SWAYAM online courses, a national digital library, virtual labs, and more. The most recent National Education Policy 2020 seeks a comprehensive overhaul of the education sector and is expected to finally bring Indian universities and schools up to the 21st century standards maintained by many Western economies.

However, uneven access to digital infrastructure has restricted the number of students who can access many of these online resources. According to review report 59 from the National Digital Literacy Mission (NDLM), around 16 rural Cr households in India do not have access to computers. Furthermore, a nationwide survey of villages conducted by the rural development ministry in 2017-18 showed that only 47% of Indian households received electricity for more than 12 hours a day.

Internet connectivity is even a challenge for tech startups in certain states like Goa. Mangirish Salelkar from the Goa Technology Association told Inc42 that internet connectivity is a major issue in the state, with cheaper internet providers selling broadband plans for INR 8K-10K for six months until last year. In order to prioritize connectivity and bandwidth for facilities and organizations on the front lines of the Covid-19 pandemic, Indian telcos and Internet providers decided to reallocate resources to certain key areas, reducing connectivity. of the Internet in certain areas of the country.

Perhaps the most important piece of the digital India puzzle is the India Stack, which is essentially a collection of open APIs, but it has revolutionized Indian banking and fintech startups. With Aadhaar as its fundamental layer, India Stack combined eKYC or digital identity, the Aadhaar-enabled payment system, the unified payment interface (UPI) and the account aggregator.

Starting with Aadhaar in 2009, India Stack has been rapidly bridging the gap between Tier 1 India and Tier 2 Tier 3 cities. India Stack, together with Jan Dhan Yojana's bank accounts, has been instrumental in bringing digital banking to the many remote parts of India. Thanks to eKYC and Aadhaar, a host of fintech companies have found a place in India.

The outlook is not entirely rosy though, many fintech companies have noted that fintech regulations in India continue to change every few months, making for a somewhat tumultuous business environment. The RBI's regulatory sandbox may alleviate some of these challenges in the coming years, but there is still something to be done regarding the spate of Aadhaar-related data leaks from government bodies, which has soured some of the progress made so far. .

Following the pandemic and movement restrictions across the country, hospitals began to use "e-Sanjeevani OPD" to provide the audiovisual facility for regular patients and elderly people to consult with doctors and avoid the hospital. The nationwide lockdown was also a boon for many telemedicine startups that had faced regulatory uncertainty for the past four years.

“We've had a lot of regulatory questions for a long time, suddenly we find ourselves becoming an essential service. That was a big regulatory change for the industry, "said 1mg founder Prashant Tandon.

The growing number of patients has also highlighted the need to improve the capacity of ventilators and respiratory aids in hospitals in India. Seeing the urgent need, Indian startups from all sectors also joined the race to develop low-cost ventilators to save COVID-19 patients. Along with them, industry experts like Mahindra, Maruti Suzuki, and more have also been helping tech startups scale their manufacturing operations, which is a key part of Make In India.

Hardware startups contributing to India's effort against Covid-19 include Noida-based AgVa Healthcare, which developed a low-cost fan the size of a toaster, weighing just 3.5kg. Similarly, Bengaluru-based Biodesign Innovation Labs is developing a portable ventilator called RespirAid for less critical patients, which is ideal for stabilizing a patient during respiratory arrest. These are all made in India and contribute greatly to the penetration of digital healthcare.

Additionally, robotic solutions created by Indian startups have also supported public health infrastructure. Robots share the workload of front-line personnel fighting Covid-19 in India. From sanitizing zones, dispensing hand sanitizers to patient monitoring, and also food and drug service, more and more hospitals are implementing automated solutions for these tasks.

These startups include Kerala Startup Mission-backed Asimov Robotics, Gurugram-based Milagrow HumanTech, Invento Robotics, PerSapien, and more.

Perhaps the most controversial part of India's fight against Covid-19 was the Aargoya Setu app. Launched in April 2020, Aarogya Setu is the government's contact tracing solution. It is said to have gotten 15 Cr downloads so far (Aug 2020). However, many have also raised concerns about mandatory use and privacy, as well as its potential use for mass surveillance.

In recent months, the focus has been on Indian software products. Perhaps the greatest recognition of India's digital ambitions came with the banning of more than 100 Chinese apps, bringing the digital economy into geopolitical battle. The app ban in China was followed by Modi's clarion call for Vocal for Local and Atmanirbhar Bharat, which has flooded India's app ecosystem with hundreds of new apps in a matter of months. Interestingly, most of these apps have pointed out that their "Made in India" label is the differentiating factor in the market. While the focus so far has been on manufacturing goods and products in India, the new wave of Indian applications is perhaps the best example of how Make in India and Digital India are interconnected.

Comments

Post a Comment